Protect what matters now

Expand your benefits

Choose from a range of optional riders

Guaranteed Purchase Options

The ability to buy additional coverage without going through the typical underwriting process can be valuable as you age or experience changes in your health.

Paid-Up Additional Death Benefit Options

Converting policy dividends into additional coverage also increases your protection and builds more cash value. You can also increase your coverage, as well as the policy’s cash value, by paying additional premiums.

Waiver of Premium

If you become disabled, your premium payments are waived and your policy remains in force for as long as you are disabled.

Accidental Death Benefit Rider

If your death is the result of an accident, your beneficiaries will receive an additional benefit.

Terminal, Critical and Chronic Illness Riders

Known as living benefits, these riders each allow you to tap into a portion of your death benefit to help cover the costs of treatment or care.

Spouse and Child Coverage Riders

Adding coverage for family members as part of your Whole Life policy can be a convenient way to further protect your family.

Policy will mature when insured reaches age 121. Payment of dividends are not guaranteed as the assumptions on which they are based are subject to change. Loans and withdrawals taken against a permanent life insurance policy will reduce the death benefit and may result in a taxable situation. Policy and features are subject to approval and may not be available in all states. Please see policy and riders for complete details. GBU and its agents do not provide tax, legal or investment advice. Please consult with a legal or tax professional prior to the purchase of any contract. Contract Form Series: ICC20-WL, FL20-WL.2, ICC20-SPWL, FL20-SPWL.2.

Gifts for children and grandchildren

Purchasing a Whole Life insurance policy for your child or grandchild is a forward-looking gift that guarantees insurability and savings. Youth 3 Pay Life life insurance is designed especially for children up to age 17.

Premiums are paid in three annual installments. Along with life insurance protection from $5,000 up to $50,000, the Youth 3-Pay Life policy accumulates cash value that can be borrowed against or used for education, to buy a home or for emergencies.

Policy will mature when insured reaches age 121. A parent or legal guardian must sign the application. If the policy is to be owned by someone other than the parent or legal guardian, the parent or legal guardian must also sign the application. Payment of dividends are not guaranteed as the assumptions on which they are based are subject to change. Loans and withdrawals taken against a permanent life insurance policy will reduce the death benefit and may result in a taxable situation. Riders are optional and have additional fees associated with them. Policy and features are subject to approval and may not be available in all states. Please see policy and rider coverage for complete details. All contracts are subject to approval. Contract Form Series: ICC19-Y3Pay, FL20-Y3Pay, ICC19-Mem3Pay, FL20-Mem3Pay.

We help deliver stability in an uncertain world

Throughout our 132-year history of navigating challenging events and volatile markets, GBU Life has fulfilled countless commitments from added financial protection for young families through increased security for retirees, and every dream in between.

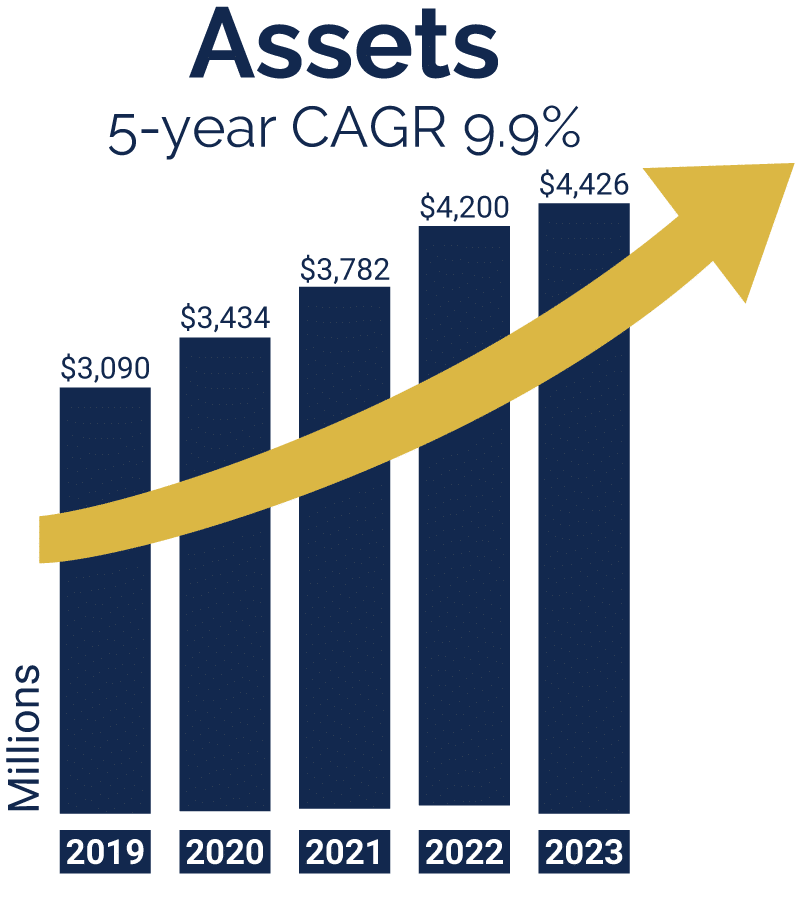

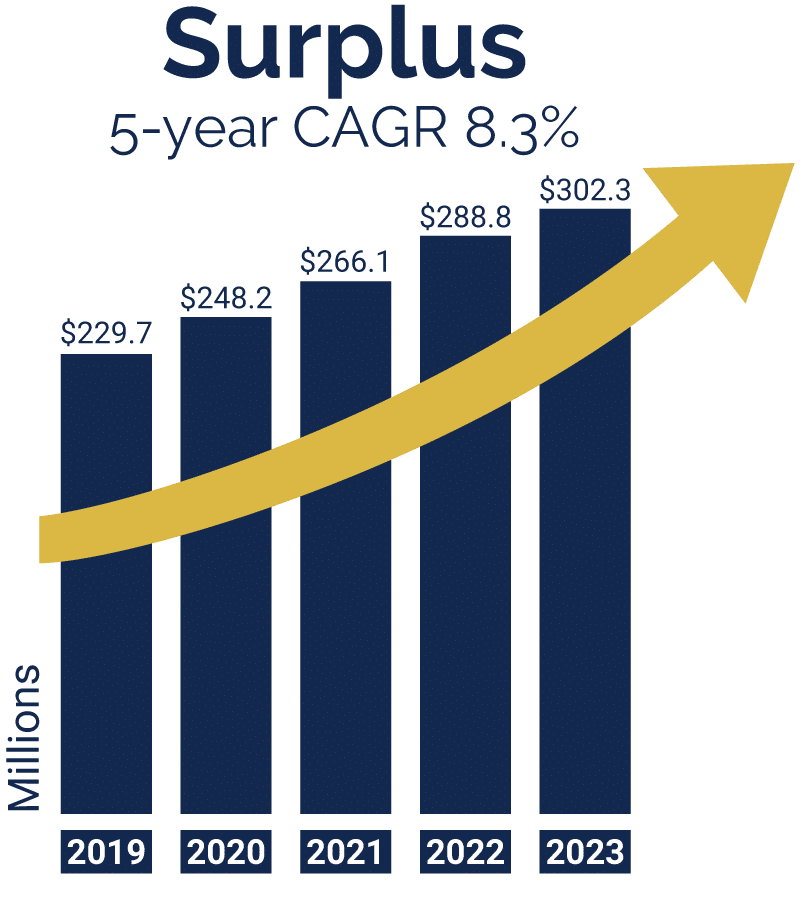

CAGR is Compound Annual Growth Rate of surplus or assets, as applicable, and was calculated for the period 12/31/18 through 12/31/23. Assets and surplus for each year is as of 12/31.

Insurance that makes a difference

At GBU Life, we specialize in life insurance and annuity products to help protect families and anchor retirements.

We do things differently at GBU as we don’t have shareholders. We don’t have clients. Instead, we have members—members who come to GBU Life to add security to their futures, build their legacies and impact the communities around them.

From the start, GBU Life has been member-owned and member-driven. As a not-for-profit company, we emphasize value—and values. Our members can realize their financial protection goals and give back to people and causes that matter most to them.

AM Best recognizes GBU Life’s fiscal responsibility and growth by rating us

A- Excellent, since 2017

As of 6/23, AM Best Company updated GBU Financial Life’s A- rating, which we have maintained since 2017. Third-party ratings are subject to change. A- (Excellent) rating is 3rd best out of 17 possible rating categories. For the latest Best’s Credit Rating, access www.ambest.com.