BU Financial Life (GBU) has seen many changes since its founding in 1892, and now helps members across the country to plan a secure financial future for their families.

In 1992, GBU employee Julie Gaita worked closely with author Wilson J. Warren to put together pieces of history for a biography of GBU Financial Life’s first 100 years. This April, the company marked its 128th year providing life insurance, annuities and member benefits to families throughout the United States. “So much has changed, even in the last 28 years,” said Gaita.

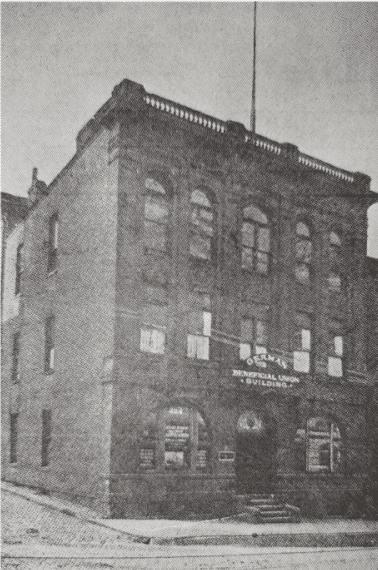

GBU Financial Life was founded as the German Beneficial Union, one of many great fraternal benefit societies that formed between the close of the 19th century and the Civil War. This period marked a great time of growth for the Pittsburgh region as household names such as ALCOA, PPG, Heinz and D.L. Clark were just getting their starts, and immigrants were flooding into the city to begin their American dreams. Since many arrived poor and unsure what lay ahead of them, they looked to fellow countrymen who had come to the US before them for support. This support was the foundation of the fraternal benefit society system, which formed to help provide benefits and social interaction to fellow immigrants.