Your Guide to Building a More Secure Retirement

Defined Benefit Annuity combines the earning potential of our Future Flex Fixed Index Annuity with the guidance of an online tool to create a solution that can help you reach your retirement goals with fewer setbacks.

When driving to an important destination, one of the first things you probably do is put the location into a GPS navigation. So, if retirement is one of the most important destinations we’ll reach in life, why are we expected to navigate there without any guidance or support? Defined Benefit Annuity is here to act as your personal GPS to retirement, so you never miss a turn on your way to a guaranteed retirement income.

Why Defined Benefit Annuity Works

Although Defined Benefit Annuity is not a defined benefit pension, it follows the same concept of those plans.

Today’s unfortunate reality is that few Americans enjoy the security that defined benefit pensions once provided to many. But that doesn’t mean you can’t create your own plan for retirement security that operates with an economic structure like yesterday’s defined benefit plans. A retiree’s top financial priority is income.

Defined Benefit Annuity gives you a strategic, disciplined, and outcome-focused strategy to make retirement security a realistic objective.

Defined Benefit Annuity can make retirement planning easier with just three simple steps.

Case Study Example

Jill, age 35, wishes to receive a $50,000 annual income beginning at age 65. She adds the following information to the Defined Benefit Annuity online tool:

> $50,000 Targeted Income

> Retire at age 65 (30 years of contributions)

> 7% assumed interest (growth) rate

The tool determines her calculated required monthly premium with an assumed interest rate of 7% is $541.93.

What Happens Next?

In year two, Jill’s annuity earns an actual interest rate of 5%, below the assumed rate of 7%. Her annual report suggests two options:

> Increase her monthly premium to $565.07 to stay on track for $50,000

> Keep her monthly premium the same and have a reduced retirement income of $49,866.

With the guidance of the annual report, Jill can determine exactly how much she needs to increase her contributions to stay on track to reach her goals.

How is Defined Benefit Annuity different from traditional annuities?

Unlike typical annuities, Defined Benefit Annuity allows regular deposits instead of a single lump payment. This solution enables you to work toward your desired retirement income over time.

What is the benefit of the Defined Benefit Annuity online tool?

The Defined Benefit Annuity online tool mimics the concept of yesterday's pension plans and helps provide a clear pathway to achieving your desired annual retirement income. Defined Benefit Annuity is a personal, private, and tax-advantaged system for building wealth and retirement security.

We help deliver stability in an uncertain world

Throughout our 133-year history of navigating challenging events and volatile markets, GBU Life has fulfilled countless commitments from added financial protection for young families through increased security for retirees, and every dream in between.

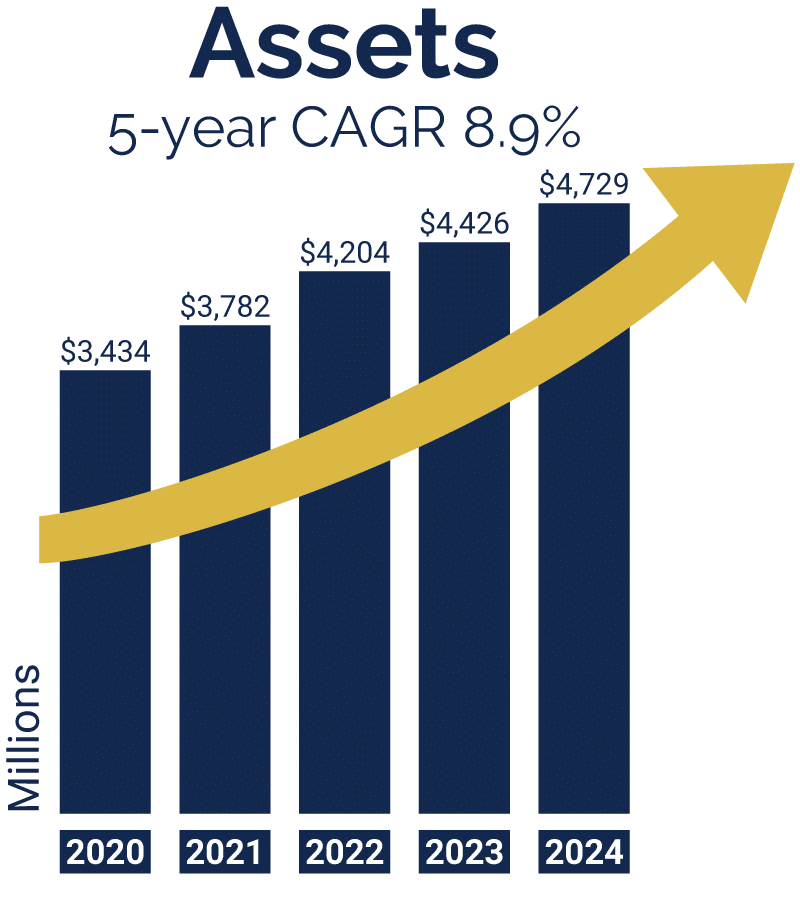

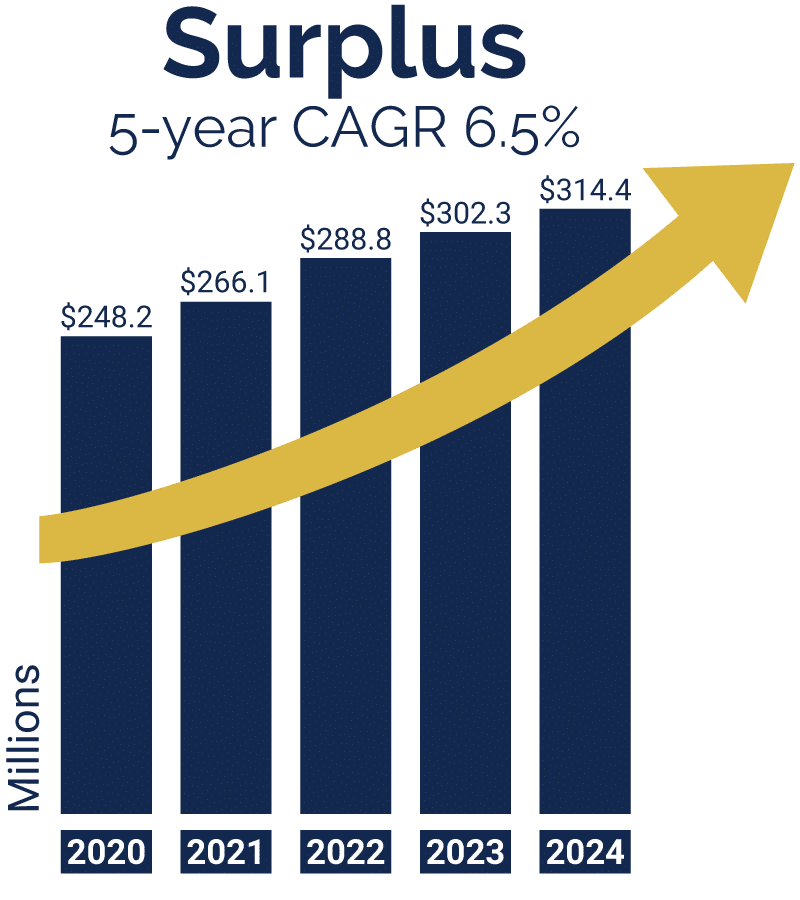

CAGR is Compound Annual Growth Rate of surplus or assets, as applicable, and was calculated for the period 12/31/19 through 12/31/24. Assets and surplus for each year is as of 12/31.