Prepare for what’s next

Immediate Annuities

Income that starts now and lasts as long as you need it

As retirement nears, financial challenges like rising healthcare costs, inflation and market volatility need to be managed.

Interest rates are determined by date of receipt of deposit. Rates are subject to change without notice. Benefits may be taxable. During the surrender charge period, withdrawals exceeding 10% will be subject to a surrender charge that may be higher than fees associated with other types of financial products and may reduce principal. See the surrender charge schedule and contract for specific details. Annuities are not short-term products. Withdrawals prior to 59½ may be subject to IRS penalties, separate from the annuity’s schedule of surrender charges. The maximum issue age is 95. The free look period is 10 days or 30 days for replacements unless noted herein. Withdrawals for amounts over those allowed during the guaranteed period are subject to surrender charges defined in the contract. The payout amount you will receive is based on your individual circumstances, the options you select at the time of application and your initial premium payment. NOT A DEPOSIT OF A BANK AND MAY LOSE VALUE-NOT BANK GUARANTEED. Contract Form Series: ICC22-SPIA_CON_(01-22), SPIA_CON_(01-22)_FL.

We help deliver stability in an uncertain world

Throughout our 133-year history of navigating challenging events and volatile markets, GBU Life has fulfilled countless commitments from added financial protection for young families through increased security for retirees, and every dream in between.

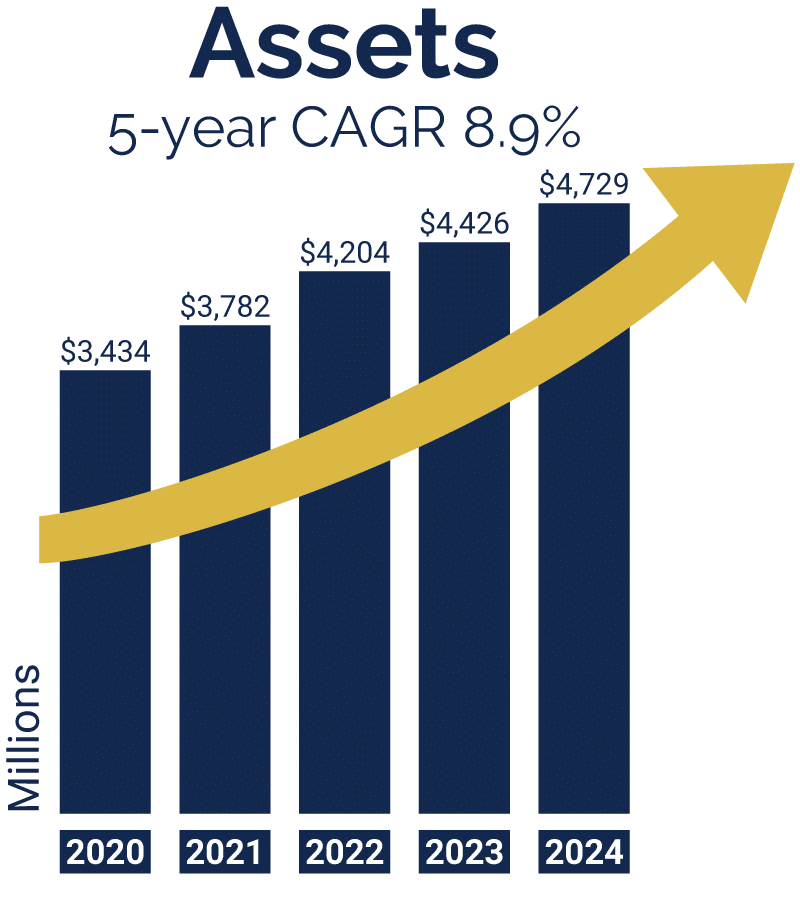

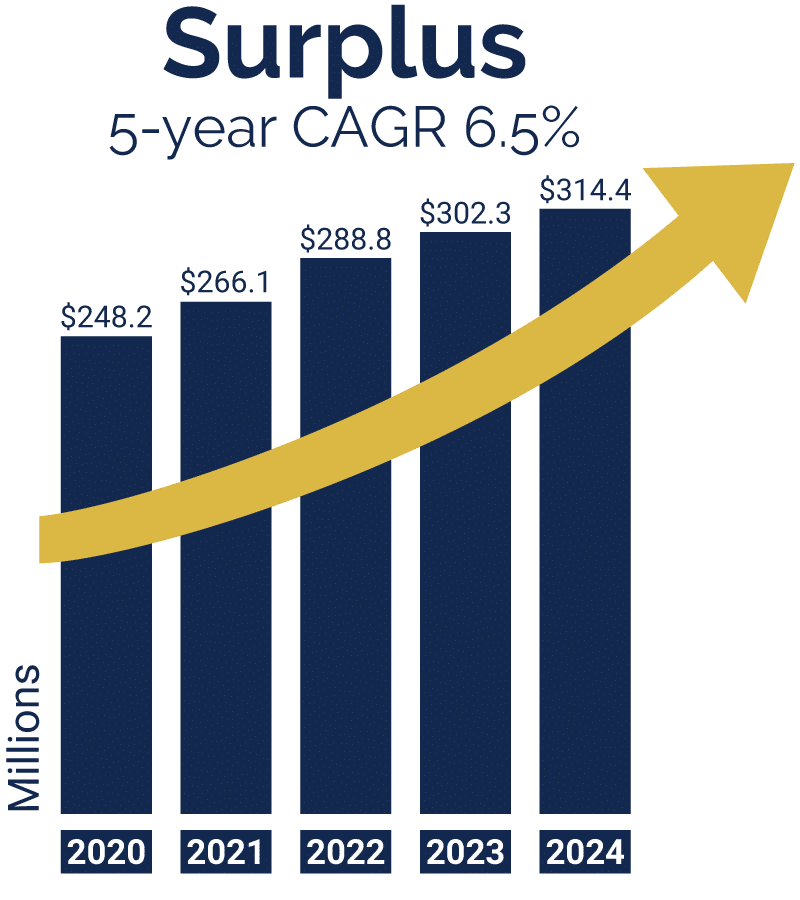

CAGR is Compound Annual Growth Rate of surplus or assets, as applicable, and was calculated for the period 12/31/19 through 12/31/24. Assets and surplus for each year is as of 12/31.

Insurance that makes a difference

At GBU Life, we specialize in life insurance and annuity products to help protect families and anchor retirements.

We do things differently at GBU as we don’t have shareholders. We don’t have clients. Instead, we have members—members who come to GBU Life to add security to their futures, build their legacies and impact the communities around them.

From the start, GBU Life has been member-owned and member-driven. As a not-for-profit company, we emphasize value—and values. Our members can realize their financial protection goals and give back to people and causes that matter most to them.

AM Best recognizes GBU Life’s fiscal responsibility and growth by rating us

A- Excellent, since 2017

As of 7/11/2024, AM Best Company updated GBU Financial Life’s A- rating, which we have maintained since 2017. Third-party ratings are subject to change. A- (Excellent) rating is 3rd best out of 17 possible rating categories. For the latest Best’s Credit Rating, access www.ambest.com.