Flexibility for the future you’re building

Future Flex

Fixed Index Annuity

Expanded earning potential with downside protection.

The Future Flex Fixed Index Annuity (FIA) can help grow your savings with carefully measured risk. This flexible premium deferred annuity earns interest when your chosen stock market index or indices perform well while simultaneously protecting against market downturns.

The Future Flex FIA allows you the flexibility to make additional contributions of $1,000 or more at any time during the four-year contract. Plus, you can choose to reallocate your money amongst three different index options every one or two years.

Watch the video

The Future Flex Fixed Index Annuity gives you:

Index Strategy Options

With the Future Flex Fixed Index Annuity, you can allocate funds to up to seven strategy options. Choose from a combination of three top-performing indices available in annual and biennial strategy options. You can also choose to increase your participation rate by paying a booster fee (click here for details). A higher booster fee is associated with a higher participation rate. Lastly, a fixed interest rate option is available.

Additional Product Information

Barclays Disclosure:

Neither Barclays Bank PLC (‘BB PLC’) nor any of its affiliates (collectively ‘Barclays’) is the issuer of any annuity products referenced herein (‘Annuities’) and Barclays has no responsibilities, obligations or duties to policyholders in Annuities. The Barclays Fortune 500 12% Index, the Barclays US Tech Index and the Barclays Agility Shield Index (collectively, the ‘Indices’), together with any Barclays indices that are components of the Indices, are trademarks owned by Barclays or are licensed to use by Barclays and, together with any component indices and index data, are licensed for use by GBU Financial as the issuer or producer of Annuities (the ‘Issuer’).

Barclays’ only relationship with the Issuer in respect of the Indices is the licensing of the Indices, which are administered, compiled and published by BB PLC in its role as the index sponsor (the ‘Index Sponsor’) without regard to the Issuer or the Annuities or policyholders in the Annuities. Additionally, the Issuer may for itself execute transaction(s) with Barclays in or relating to the Indices in connection with Annuities. Policyholders acquire Annuities from the Issuer and policyholders neither acquire any interest in the Indices nor enter into any relationship of any kind whatsoever with Barclays upon making an investment in Annuities. The Annuities are not sponsored, endorsed, sold or promoted by Barclays and Barclays makes no representation regarding the advisability of the Annuities or use of the Indices or any data included therein. Barclays shall not be liable in any way to the Issuer, policyholders or to other third parties in respect of the use or accuracy of the Indices or any data included therein.

GBU Disclosure:

Interest rates and participation rates are determined at the date of funds receipt. Rates are subject to change without notice. Optional booster fees/contract fees increase the participation rate and are deducted from the index strategy value at the beginning of the index term. Increased participation rates can result in greater interest credited. Benefits may be taxable. During the surrender charge period, withdrawals exceeding 10% will be subject to a surrender charge that may be higher than fees associated with other types of financial products and may reduce principal. Interest compounds daily over the specified term. GBU Life is the marketing name for GBU Financial Life. Annuities are not short-term products and are issued by GBU Financial Life (GBU), Pittsburgh, PA. Products and features may vary by state. Withdrawals prior to 59½ may be subject to IRS penalties. This is a summary of the contract provisions. Please refer to the contract for details of surrender charge schedule, benefits and exclusions. No statement contained herein shall constitute tax, legal or investment advice. You should consult with a legal or tax professional for any such matters. NOT A DEPOSIT OF A BANK-MAY LOSE VALUE-NOT BANK GUARANTEED.

We help deliver stability in an uncertain world

Throughout our 133-year history of navigating challenging events and volatile markets, GBU Life has fulfilled countless commitments from added financial protection for young families through increased security for retirees, and every dream in between.

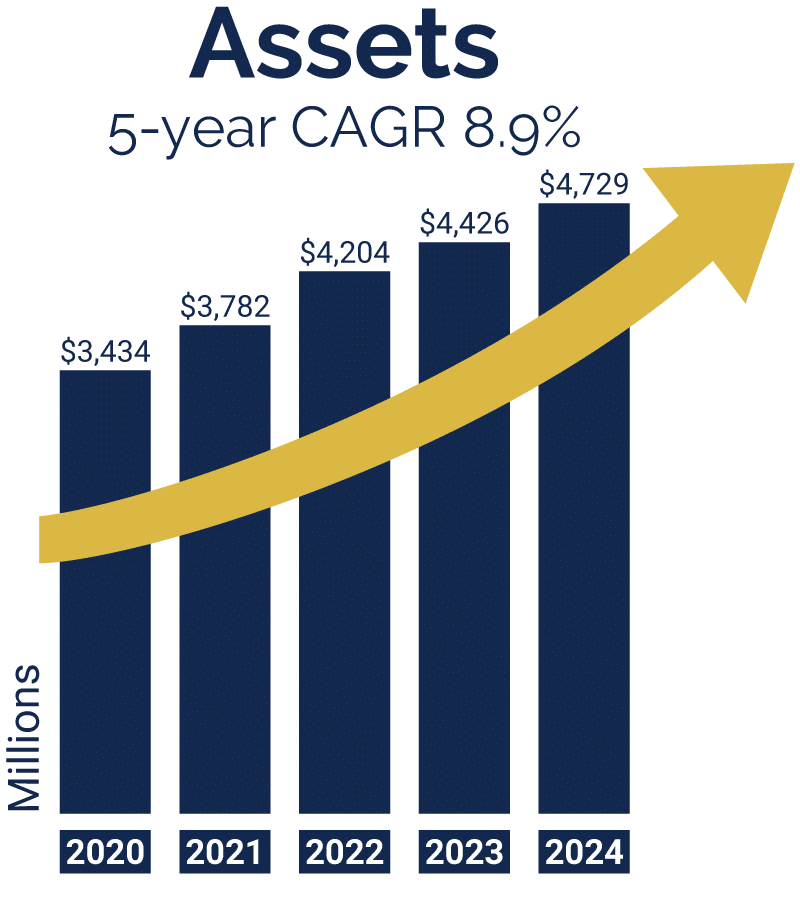

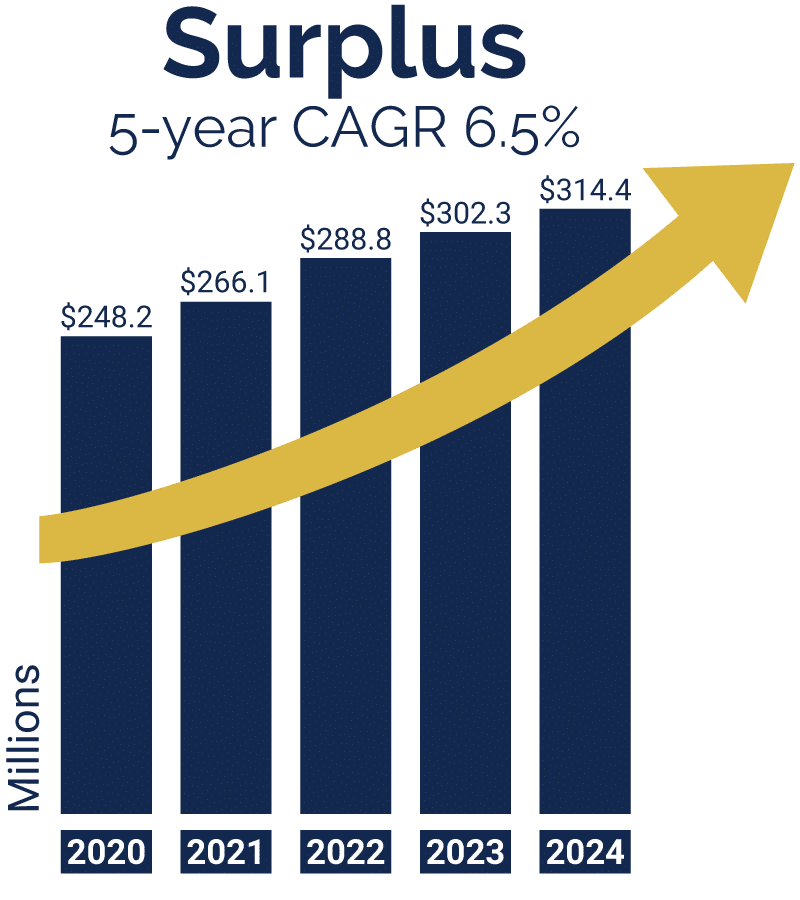

CAGR is Compound Annual Growth Rate of surplus or assets, as applicable, and was calculated for the period 12/31/19 through 12/31/24. Assets and surplus for each year is as of 12/31.

Insurance that makes a difference

At GBU Life, we specialize in life insurance and annuity products to help protect families and anchor retirements.

We do things differently at GBU as we don’t have shareholders. We don’t have clients. Instead, we have members—members who come to GBU Life to add security to their futures, build their legacies and impact the communities around them.

From the start, GBU Life has been member-owned and member-driven. As a not-for-profit company, we emphasize value—and values. Our members can realize their financial protection goals and give back to people and causes that matter most to them.

AM Best recognizes GBU Life’s fiscal responsibility and growth by rating us

A- Excellent, since 2017

As of 7/11/2024, AM Best Company updated GBU Financial Life’s A- rating, which we have maintained since 2017. Third-party ratings are subject to change. A- (Excellent) rating is 3rd best out of 17 possible rating categories. For the latest Best’s Credit Rating, access www.ambest.com.